- تاریخ انتشار : جمعه ۱۹ بهمن ۱۴۰۳ - ۳:۴۱

- کد خبر : 913 چاپ خبر

Market Correlation, Floor Price, CEX

Here’s an article about crypto, market correlation, floor prices, and CEX: Title: “Mastering Crypto Market Dynamics: Understanding Floor Prices, Correlations, and CEX” Introduction The world of cryptocurrency has experienced rapid growth in recent years, attracting both enthusiasts and investors. However, navigating the complex dynamics of the market can be daunting even for experienced traders. In

Here’s an article about crypto, market correlation, floor prices, and CEX:

Title: “Mastering Crypto Market Dynamics: Understanding Floor Prices, Correlations, and CEX”

Introduction

The world of cryptocurrency has experienced rapid growth in recent years, attracting both enthusiasts and investors. However, navigating the complex dynamics of the market can be daunting even for experienced traders. In this article, we’ll explore the key factors that influence crypto markets, including floor prices, correlations, and the role of CEXs (central exchange exchanges).

Floor Prices

Floor prices refer to the current or historical price at which a cryptocurrency is listed on a major exchange. These prices are typically determined by the exchange’s order book and can fluctuate rapidly in response to market sentiment. Floor prices serve as a reference point for traders, investors, and other market participants, helping them make informed decisions about buying and selling cryptocurrencies.

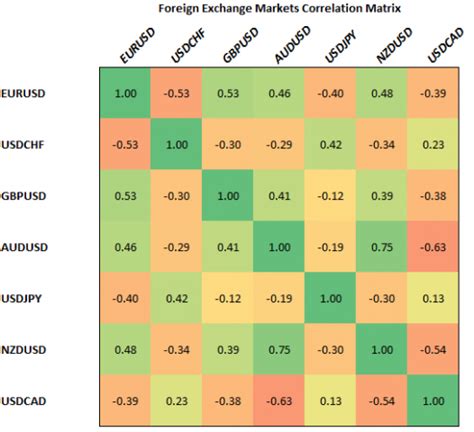

Market Correlations

Correlation is a statistical measure that estimates the relationship between two or more variables. In the context of the crypto market, correlations can be positive, negative, or neutral. For example:

- There is a strong correlation between Bitcoin (BTC) and Ethereum (ETH), as both assets perform well when one rises and the other falls.

- There is a weak correlation between BTC and ETH, as they trade independently in most markets.

Understanding market correlations is crucial for traders looking to maximize their returns by taking advantage of trends and patterns. By identifying correlated assets, you can potentially take advantage of strong buy or sell signals.

CEX

Central exchanges (CEXs) are the primary hubs where crypto markets operate. CEXs facilitate buying and selling between buyers and sellers, while also providing market makers with sources of liquidity to support their positions. Some notable CEXs in the Crypto space include:

- Binance: One of the largest and most liquid CEXs globally.

- Coinbase: A leading CEX that offers a wide range of cryptocurrencies for trading and investing.

- Kraken: A popular CEX known for its fast and reliable order book.

When choosing a CEX, it is important to consider factors such as liquidity, fees, user experience, and regulatory compliance. With so many options available, choosing the right CEX can be overwhelming. Thoroughly researching each CEX before trading will help you make an informed decision.

Conclusion

Mastering the dynamics of the crypto market requires a deep understanding of price floors, correlations, and CEXs. By mastering these key factors, traders and investors can gain valuable insight into the complex world of the cryptocurrency market. Remember to stay informed, adapt to changing market conditions, and always conduct thorough research before making any investment decisions.

Disclaimer

This article is for informational purposes only and should not be considered investment advice. Trading cryptocurrencies carries significant risks, including price volatility and regulatory changes. Always do your own research and consult with a financial advisor before making any investment decisions.

لینک کوتاه

برچسب ها

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0