- تاریخ انتشار : یکشنبه ۱۲ اسفند ۱۴۰۳ - ۷:۲۹

- کد خبر : 2154 چاپ خبر

Market Psychology And Its Impact On Litecoin (LTC) Prices

Market Psychology and its impact on Litecoin prices (LTC) The world of cryptocurrencies has been a focal point of guess, excitement and volatility in recent years. Among the numerous available CRIPTO currency, Litecoin (LTC) stands out for its unique connection of speed, decentralization and usability. As with any market, understanding the fundamental psychology that triggers

Market Psychology and its impact on Litecoin prices (LTC)

The world of cryptocurrencies has been a focal point of guess, excitement and volatility in recent years. Among the numerous available CRIPTO currency, Litecoin (LTC) stands out for its unique connection of speed, decentralization and usability. As with any market, understanding the fundamental psychology that triggers is crucial to making informed investment decisions. In this article, we will explore the concept of market psychology and explore how it affects Litecoin prices.

What is market psychology?

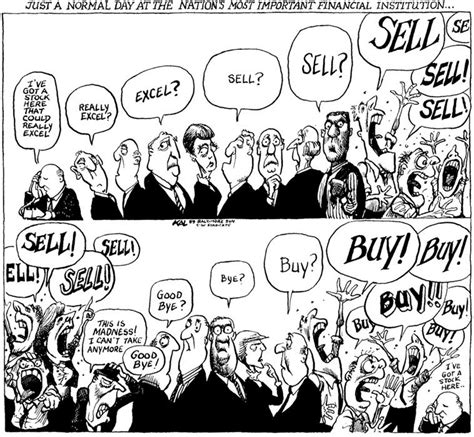

Market psychology refers to the study of how human behavior affects market movements and pricing trends. It covers various psychological factors that affect investors’ attitudes, tolerance at risk and decisions reactions. Understanding these psychological triggers helps traders, investors and analysts on the market moving the complexity of the cryptocurrency market.

Key drivers Litecoin Price: Fear and Greed

Litecoin prices are affected by a combination of fear and greed. Fear occurs when investors become concerned about the volatility of the market, uncertainty or potential risks. In this context, LTC is often considered “protection” of property, providing a safe haven for those who seek stability in the quickly change world.

On the other hand, greed plays a significant role in Litecoin’s prices. When prices increase, it can be a consequence of speculation, hype and excitement among the participants in the market. In contrast, when LTC falls, it may indicate that investors have become overly optimistic or rushing at a inflatable price.

Factors that affect the mood of the market

Several factors contribute to the feeling around Litecoin:

- Sensation Index

: The feeling index measures the collective attitude of traders according to a particular crypto currency. High feelings index may indicate increased optimism and boneness.

- News and events : breakthroughs in technology, partnerships or regulatory changes may arouse excitement among investors, starting the prices of LTC upwards.

- Market feelings : Investors often follow market leaders (eg bitcoin) to evaluate the overall mood of the cryptocurrency market. When these leaders experience strong feelings, it can affect Liteco’s prices.

- Social media and internet communities : Social media platforms and internet forums provide a line for investors to share their opinions and deal with each other. This can create the effect of snowballs, where increased discussions and guesses lead to higher LTC prices.

Case Study: Market Psychology and Litecoin Price

In order to illustrate the impact of market psychology on Litecoin prices, let us examine the movement of the prices of the CRIPTO currency during certain events:

* May 2018: Litecoin has experienced a significant increase in its price after a great upgrade to a scalabiness solution, Lightning Network. This event welcomed the predominantly positive feelings index (75%), indicating that investors were optimistic about the future LTC’s future prospects.

* October 2020: After the Pandemia Coid-19 and subsequent economic insecurity, LTC prices have fallen suddenly. The feeling index fell to low 20%, which reflected concern about the market volatility.

Conclusion

Market psychology plays a key role in designing Litecoin prices. Fear and greed are the two main drivers that affect the attitudes of investors towards the LTC. With the understanding of these psychological factors, traders and investors can better start in the complexities of the cryptocurrency market and make informed decisions.

Although the movements of past prices can serve as a guide to predicting future trends, it is crucial to approaching the market analysis with a tinted perspective, taking into account multiple sources and indicators.

لینک کوتاه

برچسب ها

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0