- تاریخ انتشار : پنجشنبه ۲ اسفند ۱۴۰۳ - ۱۲:۴۲

- کد خبر : 1742 چاپ خبر

Understanding Bullish Sentiment In Crypto Markets

Understanding bikova emotions in the cryptocurrency market The world of cryptocurrencies has experienced a meteoric increase in recent years, with exponential growth of some coins. However, in the midst of excitement and optimism, many investors remain skeptical, wondering if that trend will continue or even turn it. In order to deeply understand bull emotions in

Understanding bikova emotions in the cryptocurrency market

The world of cryptocurrencies has experienced a meteoric increase in recent years, with exponential growth of some coins. However, in the midst of excitement and optimism, many investors remain skeptical, wondering if that trend will continue or even turn it. In order to deeply understand bull emotions in the cryptographic markets, it is crucial to immersion in the psychology behind the market behavior, the confidence of investors and the technical aspects of the cryptocurrency trade.

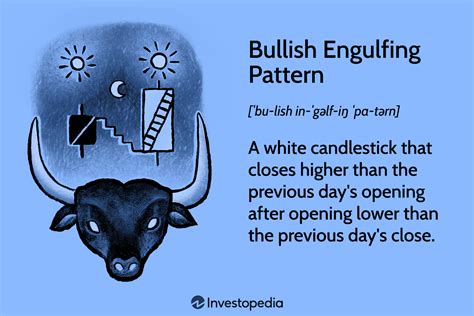

What is the bull’s feeling?

Plant emotions relate to a general attitude towards a particular possibility of investment or asset class. Bullish investor expects growth and success in his portfolio, while the bear expects investor losses and decreases. In the context of the crypto currency, the bicoists of emotions are optimistic about the future movement of prices, the rate of adoption and market trends.

Why do investors believe in crypto currency?

There are many reasons why investors believe in the cryptocurrency of the currency:

- High yield potential : Many investors see crypto currency to diversify their portfolio and get potentially high yields.

- Decentralization and autonomy : CRIPTO currency act independently of central banks and governments, which is attractive to investors seeking financial independence.

- Safety and limited supply : Most CRIPTO currency shows a limited offer, reducing the risk of inflation and making them more attractive to investors.

- Innovation and technology

: Blockchain technology behind the Crypto currency is considered to be games for industries such as finance, management of the supply chain and voting system.

Factors that affect bull emotions in the crypto market

Many factors contribute to bicou -emotions in the crypto markets:

- The trust of the Hedge Fund and investors : institutional investors such as covered funds and individual merchants are often invested in the CRIPTO currency because they have a high potential yield.

- Mainstream Adoption : Increasing the acceptance of the Crypto currency by major institutions, such as institutional investors and large companies, can increase market trust.

- Media covering and social media : positive media relationships, speakers of social media and the approval of celebrities can improve bull emotions and attract new investors.

- A regulatory environment : a favorable regulatory environment and reduced regulatory obstacles can make cryptocurrency currencies more attractive to investors.

Technical aspects of cryptocurrencies -Comlove

Understanding the technical aspects of the cryptocurrency trade is crucial for making established investment decisions:

- Market Trends : Understanding market trends, such as up or falling, can help traders recognize buying or sales opportunities.

- Rise and Falling Samples : Identifying Sampling Prices based, including an increase and a reduction in trends, can help predict future prices behavior.

- Time frames and market size : use of different time frames (such as 1 hour, 4 hours, 1 day) and indicators of the market size (such as volume, candlestick samples) for prices analysis.

- Selling voting : Understanding the Volatility Trading Strategy, such as breaking and reverse system, can help traders manage risk.

Challenges and risks of bull emotions

Although bull emotions offer a lot of benefits in the Krypto markets, there are many challenges and risks:

- Market volatility : Cryptum prices are known for their volatility, which can lead to significant prices fluctuations.

- Safety Questions : Decentralized nature of the crypto currency makes them vulnerable for hacking and security threats.

3.

لینک کوتاه

برچسب ها

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0