- تاریخ انتشار : دوشنبه ۲۹ بهمن ۱۴۰۳ - ۲۰:۱۱

- کد خبر : 1628 چاپ خبر

Stop Loss Orders: Minimizing Risk In Trading

Stop Loss Orders: Minimizing Risk in Trading Cryptocurrencies As the popularity of cryptocurrencies continues to grow, trading these digital assets has become more accessible and demanding. With prices fluctuating rapidly due to market forces, traders are increasingly looking for ways to manage risk and maximize profits. One effective strategy for minimizing risk is by utilizing

Stop Loss Orders: Minimizing Risk in Trading Cryptocurrencies

As the popularity of cryptocurrencies continues to grow, trading these digital assets has become more accessible and demanding. With prices fluctuating rapidly due to market forces, traders are increasingly looking for ways to manage risk and maximize profits. One effective strategy for minimizing risk is by utilizing Stop Loss Orders (SLOs) in cryptocurrency trading.

What are Stop Loss Orders?

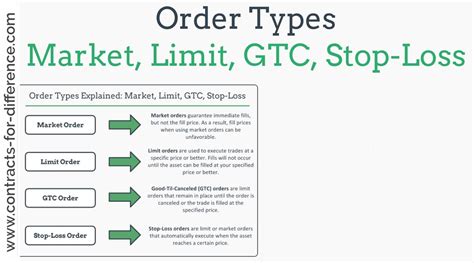

A Stop Loss Order is a type of order placed with a broker or exchange that instructs them to sell an asset at a specific price level, just before the price reaches its target. The goal of SLOs is to limit losses by closing positions when prices fall below a certain level, thereby limiting potential losses.

Why are Stop Loss Orders essential in cryptocurrency trading?

Cryptocurrency markets can be highly volatile due to various factors such as market speculation, regulatory changes, and external events. Traders who do not utilize Stop Loss Orders risk losing their entire investment if the price falls significantly. SLOs help mitigate this risk by providing a buffer between the current price level and a predetermined target price.

How to set up a Stop Loss Order in cryptocurrency trading:

To set up a Stop Loss Order, follow these steps:

- Choose a broker or exchange: Select an online brokerage firm that offers cryptocurrencies for trading.

- Create a trading account

: Register for an account with the chosen broker, and fund it with sufficient capital.

- Set up a trading platform: Download and install the trading platform on your device (e.g., MetaTrader, TradingView).

- Place a market order or limit order: Use the trading platform to place a market order or limit order for a cryptocurrency asset. Choose “Stop Loss” as the type of order.

- Set the stop-loss price and quantity: Specify the target price level (stop-loss) and the quantity (position size). Adjust these settings according to your risk tolerance and market analysis.

Best practices for setting up Stop Loss Orders:

To maximize the effectiveness of SLOs:

- Use multiple orders with different stop-loss levels

: Set up multiple SLOs at various price points to capture losses from a broader range.

- Adjust stop-loss prices dynamically: Rebalance your positions based on changing market conditions and adjust the stop-loss prices accordingly.

- Consider using hedging strategies: Combine SLOs with other risk management techniques, such as position sizing or diversification, for added protection.

Example Use Case:

Suppose you’re trading Bitcoin (BTC) with a broker that offers a Stop Loss Order feature. You’ve bought 100 BTC at $10,000 and want to set up a stop-loss order to sell the asset if it falls to $8,500 or lower. The stop-loss price is $9,250, and the position size is 1/2 of your overall position. With this setup:

- If Bitcoin’s price drops to $7,900 (the stop-loss level), you’ll close the current position.

- You’ll avoid selling at a loss when the asset reaches its target price ($8,500).

- The remaining exposure will be locked in until further market analysis reveals a potential buy signal.

Conclusion:

Stop Loss Orders are an essential tool for traders seeking to minimize risk and maximize profits in cryptocurrency markets. By understanding how SLOs work and implementing best practices, you can harness the power of stop-loss orders to navigate price fluctuations with greater confidence. Remember to stay adaptable, as market conditions may change rapidly, requiring continuous adjustments to your Stop Loss Orders strategy.

لینک کوتاه

برچسب ها

- نظرات ارسال شده توسط شما، پس از تایید توسط مدیران سایت منتشر خواهد شد.

- نظراتی که حاوی تهمت یا افترا باشد منتشر نخواهد شد.

- نظراتی که به غیر از زبان فارسی یا غیر مرتبط با خبر باشد منتشر نخواهد شد.

ارسال نظر شما

مجموع نظرات : 0 در انتظار بررسی : 0 انتشار یافته : 0